News

The Maldives collects nearly $30m as Green Tax in six months

In the first six months of this year, the Maldives Finance Ministry collected 29.75 million US dollars as Green Tax from foreigners and tourists. The Green Tax is payable by

Swedish Economists Argue for Green Fiscal Policy to Stop Recession

On 24 August in the Dagens Nyheter newspaper, two Swedbank economists, Anna Breman and Andreas Wallstrom, said in an op-ed that Sweden and the European Union should ease regulation and allow

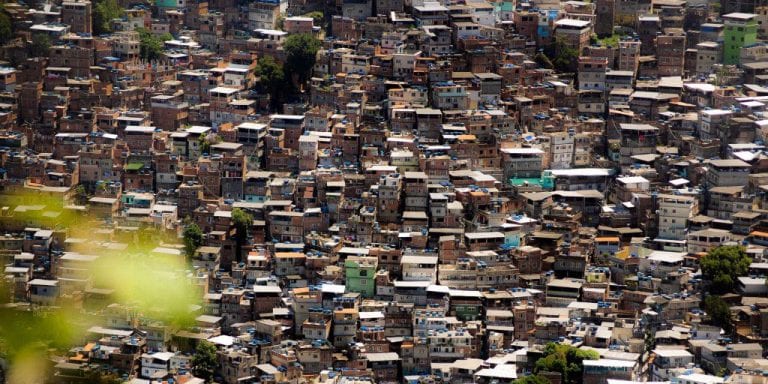

Tax, Inequality and Human Rights

An article, written by Philip Alston and Nikki Reisch on the Open Global Rights, discusses how delivering on the SDG’s promise to reduce economic inequality requires progressive taxation and effective

Lessons from several provinces in Canada on carbon pricing

A series of articles in policy options politiques take a closer look at the approach towards carbon pricing in several provinces of Canada. In British Columbia, the carbon tax was

Renewable Energy: the Cheapest Option, even Without Subsidies

A new study from the International Renewable Energy Agency assessed the Renewable Power Generation Costs in 2018. In the study, they found that unsubsidized renewable energy is now often the

Four countries that declared climate emergencies and still give billions to fossil fuels

An article on Climate Home News sheds light on incoherencies between government statements and actions. The UK, France, Canada and Ireland formally recognized a climate crisis, and yet analysis shows that

Editorial – The Energy Transition and Fiscal Policy

In a recent editorial for EC Tax Review law journal, Han Kogels goes into the ambitious targets the EU has set for itself to reduce its GHG emissions progressively by

Opportunities and challenges in China’s environmental industry

Micah Hostetter, from the Energy & Environment Group of Intralink, discusses the next step for China’s environmental industry, focusing on Chinese government spending. Tackling pollution and its impacts has been

Taxing and spending: Green fiscal and financial systems can stop environmental crisis

In a recently published Op-ed, the Chairman of Eunomia Research & Consulting, Dominic Hogg, shares his views on how the fiscal and financial system can help address the environmental crisis.