- This event has passed.

Role of Fiscal Policies in a Green COVID-19 Recovery: Experience, Best Practice and Next Steps in the Asia-Pacific Region

September 14, 2021 - September 15, 2021

SUMMARY

In September 2021 during the run-up to the COP26 UN Climate Change Conference, leading experts from governments, international organizations, think tanks and academia came together to discuss the role of fiscal policies in the Green Covid-19 Recovery in Asia-Pacific.

This online workshop, one of a series hosted by the Green Fiscal Policy Network (GFPN) in partnership with the UN Economic and Social Commission for Asia and the Pacific (UN ESCAP), focused on the potential of green fiscal policy to align environmental, social and economic goals to pave the way for a green recovery in Asia Pacific.

SESSIONS & RESOURCES

|

Session # |

Session Title |

Link |

|

1 |

||

|

2 |

||

|

3 |

||

|

4 |

||

|

5 |

SESSION 1: The Role of Green Fiscal Policies in the Recovery: Findings From the Global Recovery Observatory and the UNESCAP 2021 Socio-economic Survey

By loading the video, you agree to YouTube's privacy policy.

Learn more

Summary

In his welcome speech, Kaveh Zahedi, Deputy Executive Secretary of ESCAP, set the stage by pointing towards the ‘window of opportunity’ the crisis has brought to align Covid recovery efforts with national climate mitigation and adaption aspirations. At the same time, he made clear that only a fraction of recovery spending in Asia-Pacific developing countries has had green characteristics, showcasing the need for countries to “radically change course to avoid locking in further inequality, vulnerability and environmental degradation”. Chief of UNEP’s Resources & Markets Branch Steven Stone used his welcoming words to emphasize the centrality of fiscal policy for a successful green recovery, describing it as “the hardwire of our economies”.

Mr. Zahedi’s message was underlined by Brian O’ Callaghan from the University of Oxford, who presented the findings of the Global Recovery Observatory, which show that just 21.5% of recovery spending has been green, leaving considerable room for improvement. The lack of green investment in practice is in stark contrast to the results of a 2020 global survey of leading economists, which concluded that “green investment can bring stronger growth than traditional alternatives, while also protecting human health and the environment”.

Jiyoung Choi, Director of Green Climate Policy Division of the Ministry of Economy and Finance, presented South Korea’s ambitious Green New Deal that aims to “support the structural transition of the overall economy and society”. This innovative green recovery plan sets out to tackle significant challenges the country is facing, such as dependence on coal and the need to drive renewable energy transition and is expected create 2.5 million new jobs.

Subsequent discussions highlighted the importance of prioritizing clean and efficient spending and long-term low-carbon investments, rather than short-term unsustainable spending on fossil fuels. The contrast between average rescue and recovery spending in advanced economies (USD 12,000 per person) and emerging market and developing economies (USD 20 per person) brought to the fore the importance of a just transition, not only at national level, but also internationally.

Speakers

|

Name |

Organization |

Title |

|

Kaveh Zahedi |

UNESCAP |

Deputy Executive

Secretary |

|

Steven Stone |

UNEP |

Chief, Resources and

Markets Branch |

|

Hamza Ali Malik |

UNESCAP |

Director, Macroeconomic

Policy and Financing for Development |

|

Brian O’Callaghan |

Smith School of

Enterprise and the Environment, University of Oxford |

PhD Candidate in Energy

Finance, Australian Rhodes Scholar |

|

Jiyoung Choi |

Ministry of Economy and

Finance, Republic of Korea |

Director, Green Climate

Policy Division |

SESSION 2: Sustainable Public Financing for a Green Recovery to Achieve the SDGs and the Paris Agreement: Green Bonds and Green Budgeting

By loading the video, you agree to YouTube's privacy policy.

Learn more

Presentations

Summary

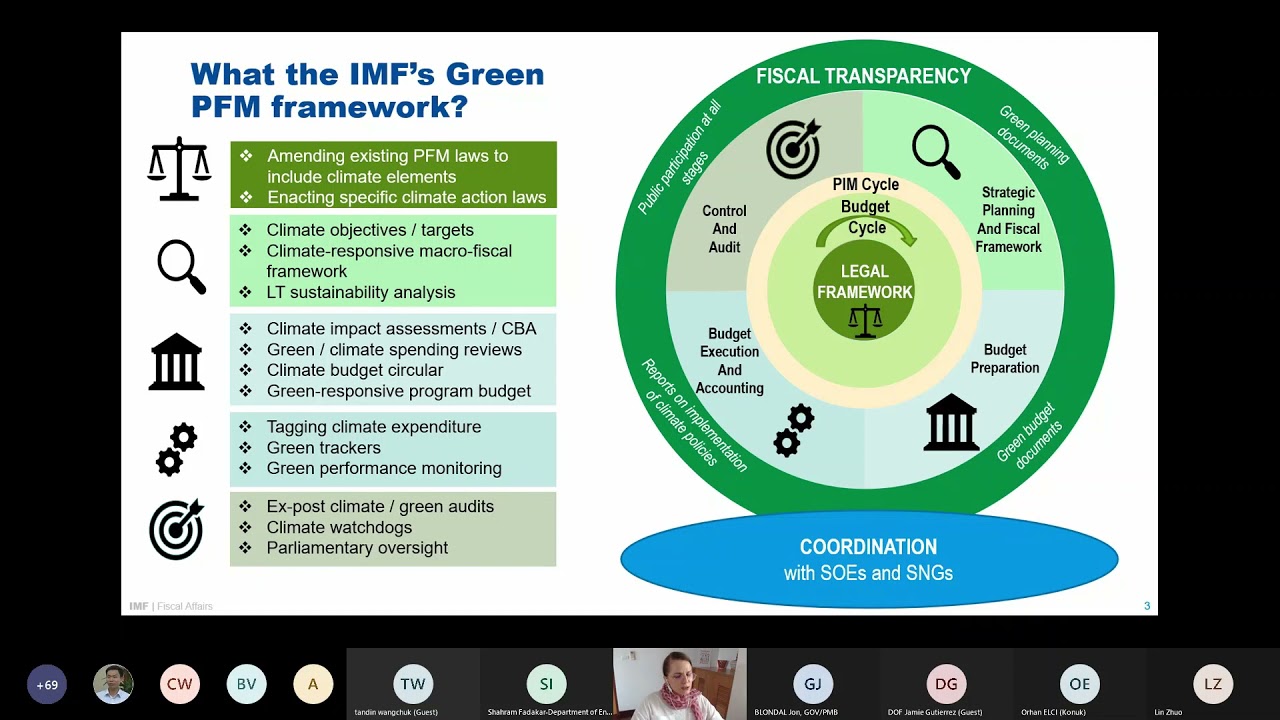

In this session, Delphine Moretti presented the IMF approach to Green Public Financial Management and explained how such approaches can help governments prioritise and reallocate resources within countries’ existing fiscal space and integrate environmental concerns systematically in budgetary decision-making. Margaux LeLong and Jon Blondal of the OECD presented the role of green budgeting within green recovery, from including climate perspectives in macro-fiscal forecasting, reporting on how stimulus packages help meet green objectives, to mobilising additional resources through green taxation. Kirthisri Wijeweera emphasised the importance of greening public finance, revenue and expenditure, to promote a green recovery within the framework of UNDP’s BIOFIN approach to biodiversity financing.

Paola Alvarez, Assistant Secretary of the Ministry of Finance of the Philippines, presented climate change expenditure tagging and described its role in identifying financing gaps in different sectors. Ms. Alvarez emphasized the role of the Philippine Sustainable Finance Inter-Agency Council in mainstreaming climate change across government to “mobilise climate finance towards investments for a green economic recovery”.

As in the first session, during the discussion speakers reiterated the need for international solidarity and climate justice in the face of the huge climate costs faced by many countries in Asia-Pacific. Indeed, an estimated USD 4.2 billion will be required to address the impacts of climate change in the Philippines from 2015 to 2030. The importance of long-term investment planning to reduce risk and avoid unnecessary and avoidable spending later on was reiterated.

Speakers

| Name | Organization | Title |

| Delphine Moretti | IMF | PFM Regional Advisor, Southeast Asia |

| Jón Blondal | OECD | Head of Division, Budgeting and Public Expenditures Division |

| Margaux LeLong | OECD | Policy Analyst, Budgeting and Public Expenditures Division |

| Kirthisri Wijeweera | UNDP | Advisor, Nature Performance Debt Instruments, Finance Sector Hub |

| Paola Alvarez | Ministry of Finance, the Philippines | Assistant Secretary |

SESSION 3: Round Table Discussion on Fiscal Policy as an Enabler for Scaling Up Private Investment in Support of a Green Recovery

By loading the video, you agree to YouTube's privacy policy.

Learn more

Presentations

Summary

Two key messages stood out during the panel discussion.

First, unequivocal statements of intent from governments and public investment in green infrastructure are needed to show the way and encourage financial institutions to provide green credit services, as well as to encourage non-financial enterprises to green their operations. Carson Wen, Chair of the Bank of Asia, showed how this might be done with reference to a new Chinese State Council guideline calling for the introduction of green taxes on pollution, carbon emissions and resources, the establishment of a green stock index, the development of futures trading for carbon emissions rights, and the development of a financial model for green industrial transformation. In a similar vein, Yuki Yasui of UNEP-FI reported that governments’ net zero commitments have been the single most important incentive for financial institutions and businesses to make comparable pledges, while Hitesh Kataria of KPMG said of carbon pricing: “the intent is just as important as the right price”.

Second, efforts to introduce a carbon price – fossil fuel subsidy reform, carbon taxes and emissions trading – have a role to play in driving low-carbon investment, as they create a business environment in which low-carbon investments are competitive. As Mr. Wen recapitulated, competitiveness concerns are a key motivator for green behaviour: “carbon taxes definitely will drive businesses into moving into greener sectors, because this is how they can reduce their costs”. To create such an environment, business “would like to see a legally binding long-term carbon pricing corridor…with predictability based on a 1.5-degree trajectory”, according to Ms. Yasui. Internal carbon pricing within companies can also enhance competitiveness, reported Hitesh Kataria from his experience at the Mahindra Group, as an internal price fosters better long-term decision-making and drives efficiency savings and emissions reductions.

Speakers

|

Name |

Organization |

Title |

|

Carson Wen |

Bank of Asia |

Chairman |

|

Yuki Yasui |

UNEPFI |

Asia Pacific Regional Coordinator |

|

Vineil Narayan |

Ministry of Economy, Republic of the Fiji Islands |

Acting Head of Climate Change & International Cooperation |

|

Tiza Mafira |

CPI Global |

Associate Director |

|

Hitesh Kataria |

Independent |

Sustainability Expert |

SESSION 4: The Potential for Fossil Fuel Subsidy Reform and Carbon Pricing to Contribute to Building Forward Better

By loading the video, you agree to YouTube's privacy policy.

Learn more

Presentations

Summary

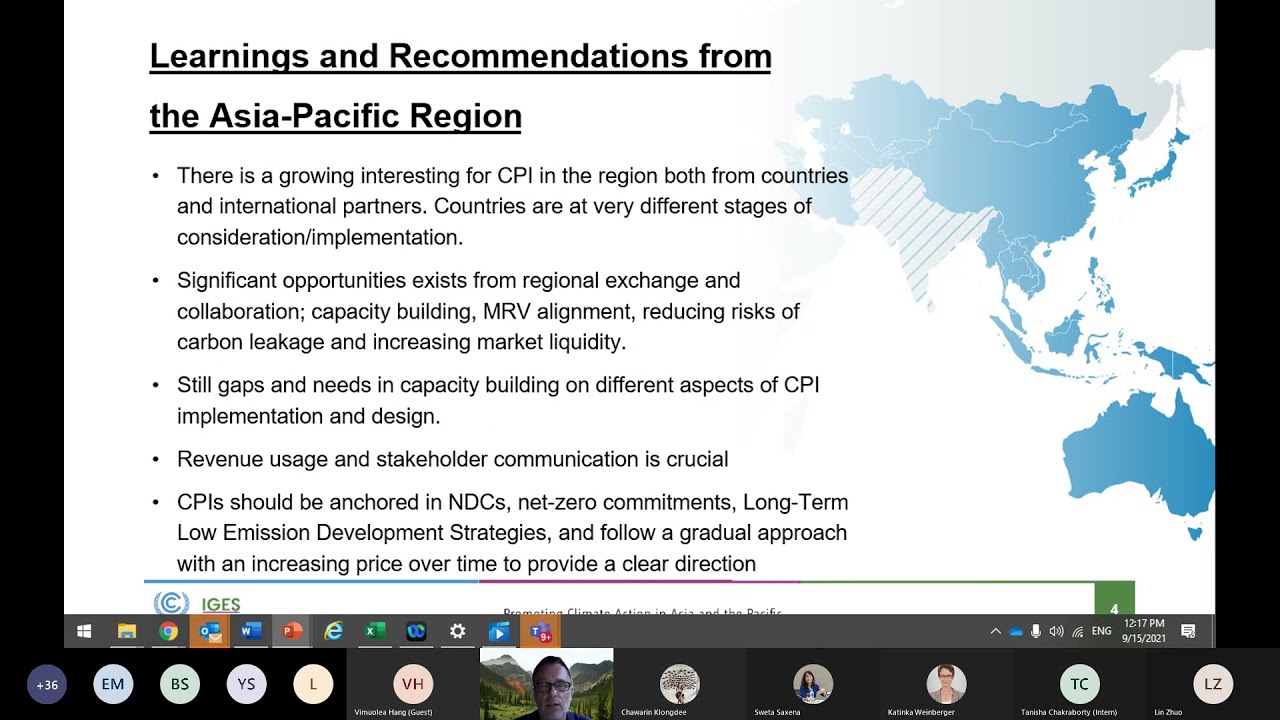

The first part of this session focussed on support available to facilitate the introduction of carbon pricing, which is particularly important given the challenges many countries in the region face due to high dependency on coal and other fossil fuels. Jens Radschinski of UNFCCC reported on the potential role of regional dialogues, which can facilitate the exchange of learning on the design of carbon pricing instruments, help countries identify successful strategies and replicate them, and create a platform for countries to explore opportunities to link carbon pricing instruments. Aneta Nikolova presented ESCAP work on how carbon pricing can contribute to a green recovery, and an upcoming ESCAP carbon pricing tool, which will allow countries to input data and identify macroeconomic, environmental and social impacts of different carbon prices and in this way, inform the development of green recovery strategies.

Presenting the case of the Government of Kazakhstan, Aiman Yessikna shared insights into the progression of the emissions trading system, highlighting how the country was able to improve the carbon registry and transition to a benchmarking method that followed best international practice to effectively allocate allowances.

Although the discussion highlighted low carbon prices in the region – the highest, in Singapore, is currently less than USD 4 / tCO2 – it also revealed a certain optimism that carbon pricing would make progress in the coming years, with several countries in the region with carbon pricing in place, such as Japan, China and Singapore, and others under development, including Indonesia, Vietnam and Uzbekistan.

Speakers

| Name | Organization | Title |

| Jens Radschinski | UNFCCC Regional Office | Regional Lead |

| Aneta Nikolova | UNESCAP | Environmental Affairs Officer |

| Aiman Yessekina | Republic of Kazakhstan | Director, Department of Inventory |

| Katinka Weinberger | UNESCAP | Chief, Environment and Development Policy Section |

SESSION 5: The Political Economy of Green Fiscal Policies in the Context of Green Recovery

By loading the video, you agree to YouTube's privacy policy.

Learn more

Presentations

Summary

In the final session, participants discussed the political economy of green fiscal policies with a view to overcoming barriers to their implementation.

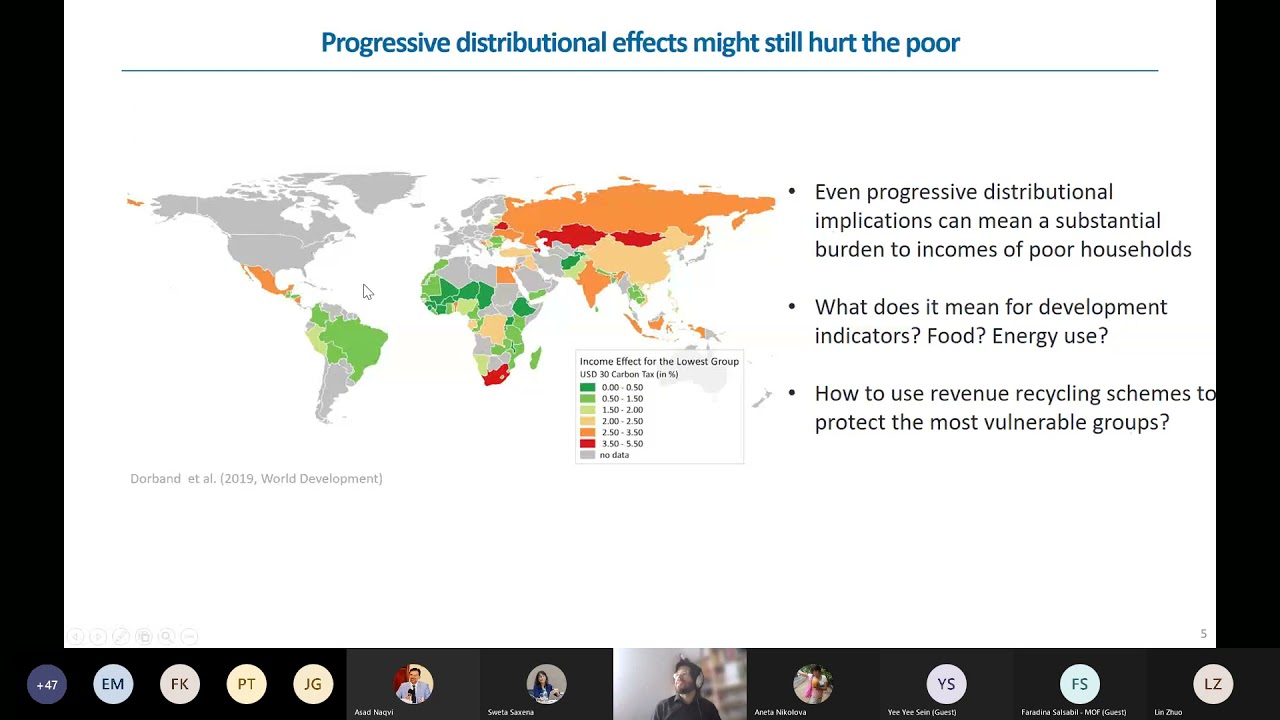

Jan Steckel from the Mercator Research Institute on Global Commons and Climate Change explained that although carbon prices would be progressive in most countries, this masks variations in impacts on income groups, which governments must consider when designing carbon pricing instruments to ensure a just transition. Following on from this, Dudi Rulliadi from the Indonesian Ministry of Finance highlighted the very real challenges in developing a carbon market alongside a carbon levy, including timing, design of compatible trading and carbon levy instruments, determination of the cap and carbon levy rates, and implementing accompanying policies to minimize negative impacts while optimising economic and environmental benefits.

Mr. Rulliadi also emphasised that “access to green sustainable finance is the most important constraint for a green recovery” and highlighted the stark contrast in capacity to spend on green recovery in advanced economies and emerging market and developing economies. In this context, Asad Naqvi, Head of the PAGE Secretariat, underlined the kind of hard decisions policymakers face when making fiscal policy decisions, particularly in the absence of good social protection policies, and underscored the need for inclusive recovery measures.

Finally, picking up on these topics in her closing remarks, Sandra Spies, Head of Section for Environmental Policy, Biodiversity and Forests at the GIZ, underscored the importance of political leadership, careful policy design, good communication, and inclusivity when implementing green fiscal policy to secure political buy-in.

Hamza Ali Malik, Director of Macroeconomic Policy and Financing for Development at ESCAP, rounded off the workshop by stressing the need for coalitions within civil society and effective stakeholder engagement – including with youth, and the poor – to facilitate consensus building and facilitate the continuation of green fiscal policies “fundamental” for an effective green recovery.

Speakers

| Name | Organization | Title |

| Jan Steckel | Mercator Research Institute on Global Commons and Climate Change | Head, Working Group on Climate and Development |

| Dudi Rulliadi | Ministry of Finance, Government of Indonesia | Senior Policy Analyst, Fiscal Policy Agency |

| Asad Naqvi | PAGE (Partnership for Action on Green Economy) | Head, PAGE Secretariat |

| Sweta Saxena | UNESCAP | Chief, Macroeconomic Policy and Analysis Section |

| Sandra Spies | GIZ | Head of Section, Environmental Policy, Biodiversity, and Forests |

| Hamza Ali Malik | UNESCAP | Director, Macroeconomic Policy and Financing for Development |

The Latest Green Fiscal Policy Updates.

Sent straight to your inbox.

- Green fiscal policies have the power to shape our relationships with the environment and each other.

- Subscribe to the GFPN Newsletter, the world's first and only newsletter focused solely on green fiscal policy.

- Every other week, we'll give you the latest green fiscal news, insights, research, resources, events, and more.

Details

- Start:

- September 14, 2021

- End:

- September 15, 2021

- Event Tags:

- GFPN Workshop

Venue

- Online

Organisers

- Green Fiscal Policy Network

- United Nations Economic and Social Commission for Asia and the Pacific