Multilateral development banks can help developing countries achieve economic stability by repurposing policy-based financing for low-carbon, climate resilient development as impacts from climate change continue to add costs in already debt-burdened economies.

After making a joint declaration in 2017 to align with the Paris Agreement on climate change, most multilateral development banks (MDBs) will start applying Paris-aligned approaches across their new activities in the next two years. However, as things stand, the only movement MDBs have made in one key area — policy-based operations (PBOs) — is sharing broad principles for assessing alignment.

PBOs provide budget support in exchange for policy actions in developing countries. To date, PBOs have provided finance in exchange for reforms that improve things like public finances, social safety nets and key sectors such as energy, banking, or agriculture. The idea is that these policy actions will put countries on firmer economic footing and increase the effectiveness of development investments, making them less likely to need further support. They are particularly relevant given the high levels of debt distress facing many developing countries.

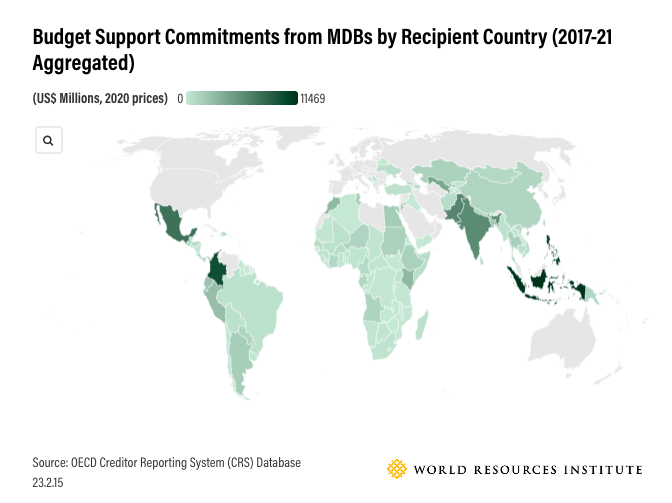

Only four of the MDBs that are part of the Paris-alignment joint declaration issue PBOs — the African Development Bank (AfDB), Asian Development Bank (ADB), Inter-American Development Bank (IDB) and World Bank — but their PBOs are significant: Between 2015 and 2020, their associated budget support accounted for $139 billion, or 38% of the total new financial commitments made by these MDBs.

However, there’s risk that without a robust approach on climate, not only will developing nations not have the support they need for a low-carbon and climate resilient economic future, but PBOs might actually undermine countries’ capabilities for sustainable development.

Aligning Policy-Based Finance with the Paris Agreement

One of the biggest challenges MDBs face is in pinpointing what it means to align activity with the Paris Agreement, especially when the bank itself has little say over how the finance provided is ultimately used. In the case of PBOs, this is because the finance is provided directly to the government’s budget.

Governments request PBOs to improve their overall economic stability and deliver reform packages for development goals. Budget support can meet short-term needs, but PBOs — through collaboration between governments and MDBs — can also complement existing government strategies for medium- and long-term macroeconomic, fiscal and social stability.

The amount of budget support is mainly determined by the country’s development finance needs — including the ability to sustainably repay the loan being provided — and volumes are thus concentrated in large countries, like Indonesia, the Philippines or Colombia.

Governments badly need funding for climate action, but they also need reforms that can secure a stable policy environment and level playing field for such investments. Given existing debt issues, many are loath to take on further obligations — unless the terms are right. Banks and their shareholders should therefore plan to offer more attractive budget support for policy actions that promote a just transition to climate neutrality by 2050.

Climate and economic goals cannot be easily disentangled. Countries need fiscal health to be ready to invest in climate action or respond to climate impacts. Moreover, climate risks threaten economic stability; economies unprepared for climate impacts and changing business models will suffer. At minimum, therefore, policy actions should not exacerbate vulnerability to climate risks. Even where such effects are indirect, they can land countries in a vicious cycle that undermines the economic stability objective of PBOs.

For example, Chad is the third-most vulnerable country in the world to climate change and the least prepared to combat its effects. The oil sector represented 45% of government revenues in 2018 and most of its economy depends on government spending.

In 2019, the World Bank provided a PBO to Chad that did not include how transition risks – such as declining demand for oil resulting in a decline in oil prices – could affect economic stability.

The text of the PBO states that fiscal stabilization reforms proposed through the PBO for managing Chad’s oil revenues “are not likely to have negative impacts on the country’s natural assets” because they are “policy-oriented.” The reforms proposed did not contain measures that could limit the vulnerability to a structural decline in oil prices.

In 2022, only three years after Chad received the PBO, a sharp drop in oil prices placed Chad in debt distress once again while more than 1 in 10 Chadians faced severe food insecurity. The government struggled to restructure a private sector loan backed by future oil proceeds from its state-owned enterprise, delaying budget support from the International Monetary Fund (IMF) and further constraining its ability to finance essential services during an ongoing humanitarian crisis.

Right now, MDBs lack the processes to diagnose and prevent situations like Chad’s in reforms supported by PBOs. They shouldn’t just aim to do no significant harm in policy actions — PBOs can actively support fiscal stability, resilience, and climate action together through structural transformation.

Here are several PBOs provided by MDBs where countries successfully integrated climate and development in their policy actions, across sectors and geography:

Policy Signals for Climate Action in Morocco

In 2019, an AfDB loan of $308 million to Morocco aimed to lay the foundation for a “diversified and inclusive economy that is resilient to external shocks, particularly climate shock” in a PBO series which notably:

- Coordinated a domestic policy signal for climate action: One policy action supported a framework for new financing products in Morocco’s guarantee fund. This enabled a subsequent policy action which supported the Ministry of Economy and Finance to design a green financing product for small enterprises that would be managed by the same fund.

- Harmonized support with development partners: The AfDB coordinated green economy objectives with the European Union, which also provided budget support to Morocco.

Specialized Budget Support for Climate Mainstreaming in the Philippines

In the Philippines, the ADB’s $500 million loan in 2020 expanded the availability of disaster relief financing with budget support for policy reforms that would mainstream climate and disaster resilience across the work of various government units.

The financing is set to disburse immediately following a disaster, whether from a natural hazard or for pandemic response. This frees up money when it is needed most.

Effective mainstreaming of climate across public institutions can be a challenge. This PBO facilitated cross-cutting reforms in local governance, social protection, and health services that improved coordination, domestic resource mobilization, and enhanced mandates alongside targeted support to increase capacity, for example, by improving the country’s parametric disaster insurance scheme.

Expanding Government Budgets for Resilience in the Bahamas

Most PBOs support government budgets with a sovereign loan, but budget support can be provided as a grant or guarantee to offer more attractive terms for environmental policy actions that increase resilience. Policy-based guarantees can lower sovereign debt costs and attract private creditors or investors — even in restructuring negotiations, such as the AfDB’s $10 million guarantee to the Seychelles which mobilized a $136 million loan at 3.95% in 2010 when the government sought to restructure $320 million of its debt at a time when commercial finance would have been outright impossible.

In 2022, the IDB guaranteed $200 million for a sovereign bond issuance by the Bahamas to support reforms for the “Blue Economy” and enhance resilience by improving management of marine resources and climate risks in coastal and offshore areas. The policy-based guarantee is complemented by technical support for economic diversification and prospecting investments that could be financed by a Blue Bond.

Accelerating Resilience to Climate Change Amid Economic Headwinds

All eyes are now on the MDBs to rise to the climate challenge while navigating a complex economic and political environment. Developing countries face rising debt distress and food crises while a global recession looms. Leaders of developing countries have highlighted the interconnection of debt and climate action through initiatives like the Bridgetown Agenda and recent push for debt-for-nature swaps. In their traditional role supporting development and reducing poverty, MDBs support governments when times are tough. PBOs offer an opportunity to relieve fiscal pressures while advancing policies to deliver climate action.

The world recognizes this. U.S. Treasury Secretary Janet Yellen has stated that development banks “can use policy advice and conditionality to encourage countries […] to direct funding towards investments with broader benefits,” such as climate action.

To deliver on this promise, MDBs will also have to make their financing more attractive. Over 90% of MDBs’ climate finance was raised using debt between 2016 and 2020, and three-quarters did not include a grant element. In addition to operational reforms within PBOs, G20 governments should coordinate clear statements of support for MDBs’ Paris Alignment agenda; this could follow from the report to the G20 on capital adequacy, which contains several recommendations for boosting the amount of money MDBs can outlay.

Aligning PBOs with the Paris Agreement is increasingly urgent as climate change continues adding costs in already debt-burdened economies. Policy-based finance has transformative potential to support climate resilience and countries’ development objectives but will need to be repurposed for these aims.

To learn more about supporting a just transition in MDBs’ policy-based operations, read our working paper: Aligning Policy-Based Finance with the Paris Agreement.

By Carolyn Neunuebel, Valerie Laxton and Hayden Higgins.

Click here to see the original post on World Resources Institute website.