The recent IPCC AR 6 synthesis report warned the world that global warming beyond 1.5℃ might be unavoidable unless limiting global greenhouse gas (GHG) emissions to peak before 2025 at the latest, and be reduced by 43% by 2030. This means that the world needs to take more ambitious climate actions to maintain environmentally sustainable planet.

On this point, it should be noted that the global financial systems have been unable to fill the investment gaps required to meet caron neutrality. This reflects the problems of mispricing, which arises from the presence of low carbon prices that do not adequately reflect the social cost of emitting GHGs. To accelerate the pace of transition towards carbon neutrality, financial institutions, therefore, need to improve their understanding of climate risks and related risk management. This is essential to foster a sustainable finance market given that realizing a carbon-neutral economy requires a large amount of investment and the mobilization of funds for that purpose.

Moreover, as companies increasingly face physical risks, transition risks, and liability risks, the financial institutions financing such companies should be aware that they may face financial losses. Financial institutions, including banks, for example, have to understand that their loans and investments provided to emission-intensive companies may become non-performing in the future if those companies find it difficult to recover the costs of fixed asset investment—thus, making those assets stranded and lowering companies’ repayment capacity and returns. If there are many financial institutions that finance such industries and companies, there is a risk that the stability of the financial system will be threatened.

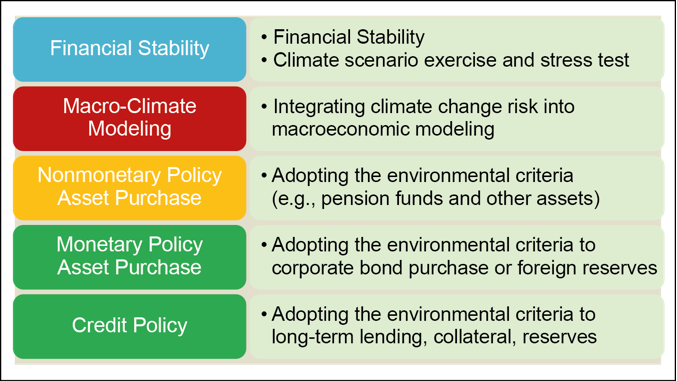

Reflecting these views, central banks and financial regulators are becoming increasingly aware that they can no longer take neutral positions on global warming issues. There are several climate-related actions that central banks and financial regulators can take. Namely, the climate and other environmental factors can be incorporated into financial stability prudential frameworks, macro-climate modeling, assets purchase for non-monetary policy purposes, and monetary policy operations (see Table).

Table: Central Banks’ Possible Climate Actions

Source: Prepared by the author based on NGFS (2021).

How to Cope with Climate-Related Financial Risks under Prudential Policy

A consensus is gradually emerging in the world that central banks and financial regulators should view climate risks as a major financial risk. Central banks generally cope with financial stability through macroprudential policy while financial regulators tend to focus on microprudential policy. The Financial Stability Board (FSB) stressed the need to improve companies’ and financial institutions’ disclosure with data collection, promote financial institutions to perform climate scenario analysis, and financial authorities to improve their surveillance, as specified in the roadmap (FSB 2021). More than 30 central banks and financial regulators have started to incorporate climate risks into financial stability frameworks by requiring major financial institutions to conduct climate scenario analysis. The analysis is becoming central to help deepen financial institutions’ understanding of climate risks and improve their risk management.

Climate scenarios are provided, for example, by the Network of Central Banks and Supervisors on Greening the Financial System (NGFS). Financial authorities can use them as reference and make adjustments reflecting some country- or regional-specific factors (NFGS 2022). The climate scenarios can be decomposed into (1) Orderly scenarios (Net Zero scenario and Below 2°C scenario), (2) Disorderly scenarios (Delayed 2°C scenario and Divergent Net Zero scenario), and (3) Hot House World scenarios (Nationally Determined Contributions scenario and Current Policies scenario). Transition risks are higher under the Orderly scenarios while physical risks are much higher under the Hot House World scenario. The main scenarios are Net Zero scenario, Delayed 2°C scenario, and Current Policies scenario.

Beyond such analysis, growing discussions have taken place in recent years on how to include climate-related financial risks in the Basel framework among the Bank of England (BOE), the European Central Bank (ECB), various EU financial regulators, Basel Committee on Banking Supervision (BCBS), and the Bank for International Settlements (Shirai 2023). As it takes time to collect consistent data from financial institutions (and their corporate counterparties) and to refine methodological approaches, the adoption of the Pillar 1 framework (minimum capital requirement) may not become feasible soon. This is because under the Pillar 1 framework credit risks, for example, are calculated for a one-year time horizon based on historical loss experience and such historical loss data are not available for climate risks. In addition, more forward-looking approaches is necessary when considering climate risks that tend to be amplified over time and non-linearly. Thus, the Pillar 2 approach is more feasible as capital assessment can be made using climate scenario analysis and stress test more flexibly. Some European banks have already begun to consider climate risks and accumulate capital mostly under the Pillar 2 framework.

Central Banks’ Monetary Policy Responses to Climate Risks

There are several possible monetary policy options for central banks to take to promote greening the financial market. These options include asset purchases, credit operations, and collateral used in central banks’ operations against financial institutions when central banks conduct credit operations.

Asset purchases could take a tilting approach by increasing the weight of greener assets in total asset purchased and/or negative screening in some cases. The tilting approach was adopted into the ongoing reinvestment strategy by the ECB in October 202. A tilting approach is recommended if it is important to encourage emission intensive sectors and companies to reduce GHG emissions. Moreover, central banks may provide long-term climate related loans to financial institutions. Such credit operations could take the form of lowering interest rates conditional upon that such financial institutions have extended climate-related finance to the private sector. Central banks could also lower lending rates for financial institutions whose composition of low-carbon assets accepted as collateral is greater. The central bank of Brazil, the Bank of Japan, and the PBOC have adopted environmental criteria in their lending programs.

Moreover, a number of central banks have already begun to integrate climate and other sustainability criteria into their foreign asset management frameworks. The Monetary Authority of Singapore is the first central bank that adopted emission targets on its investment portfolio mostly arising from foreign reserves based on the carbon intensity of its equities and corporate bonds portfolio.

Central Banks’ Mandates: Financial Stability and Price Stability

Central banks are responsible for achieving price stability under the monetary policy mandate and financial stability under the prudential policy mandate set under the central bank acts. While it is possible for central banks to consider climate risks within their existing mandates, not all central banks are acting in the same direction so far. There are a growing number of central banks that focus on climate related financial stability as described above.

Meanwhile, few central banks have adopted green monetary policy since consensus has not emerged yet on how to incorporate climate risks in their price stability mandate. The U.S. Federal Reserve places more emphasis on climate-related financial risks and prudential perspectives while the ECB focus on both mandates (Shirai 2023). Moreover, the short-term interest rate, which is central banks’ main monetary policy tool, is intended to influence all the economy and sectors equally. Thus, this effect may offset some impacts of climate-related asset purchases and credit operations. As many countries are expected to take more climate policies and tighten environmental regulations, central banks may be more encouraged to take green monetary policy. In any case, central banks can start now by promoting more financial institutions to deepen their understanding about climate-related financial risks and improve their risk management strategies. These efforts will certainly help foster more effective sustainable financial markets.

Author

Sayuri Shirai is a visiting fellow and advisor for sustainable policies at ADBI, a professor at Keio University, and a former policy board member at the Bank of Japan.

References

Financial Stability Board (FSB). 2021. FSB Roadmap for Addressing Climate-Related Financial Risks, July 7. https://www.fsb.org/wp-content/uploads/P070721-2.pdf

Network of Central Banks and Supervisors for Greening the Financial System (NGFS). 2021. “Adapting Central Bank Operations to a Hotter World: Reviewing Some Options”, NGFS Technical Document, March. https://www.ngfs.net/sites/default/files/media/2021/06/17/ngfs_monetary_policy_operations_final.pdf

NFGS. 2022, “Climate Scenarios for Central Banks and Supervisors”, September 6. https://www.ngfs.net/en/ngfs-climate-scenarios-central-banks-and-supervisors-september-2022

Sayuri Shirai. 2023a. “Green Central Banking and Regulation to Foster Sustainable Finance,” Asian Development Bank Institute Working Paper No. 1361. https://www.adb.org/publications/green-central-banking-and-regulation-foster-sustainable-finance