This blog discusses price instruments in fishery regulation to ensure sustainability of fishery resources. We focus on economic instruments and price-based instruments including tax policies in fisheries and fishery subsidies in particular.

Basak Bayramoglu is research fellow in economics at INRAE, at the Center of Public Economics (Economie Publique), Paris. Her research mainly includes the study of international agreements on the environment. She is also interested in the evaluation of environmental externalities due to agricultural and trade policies. She holds a PhD in economics from the ENPC. Her research is available at https://sites.google.com/site/basakbayramoglu/home.

Jean-François Jacques is full professor of economics at the university Gustave Eiffel (UGE) and belongs to the unit research ERUDITE. His research concerns mainly environmental economics, economics of natural resources and public economics.He holds a PhD from University Paris 1 Panthéon-Sorbonne. His research is available at : https://sites.google.com/site/jacquesjfa/

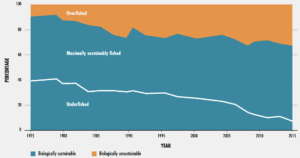

THE STATE OF FISHERIES RESOURCE IS IN AN ALARMING STATE

Around the world, fisheries resources which by nature are renewable are dropping drastically because of overfishing and overcapacity of fishing fleets (Clark, 2006). FAO (2018) reports that in 2015 about 93% of world marine fish stocks were being maximally sustainably fished or overfished (figure 1). Since the sea is a common-pool resource, regulating fishing is complex for both developed and developing countries. If fishing activity is seen by states as socially useful there is no incentive to reduce it. If fish are exported[4], the interaction between export pressure and other political pressures and market failure can exacerbate overfishing (Erhardt, 2018).

Also, measures to reduce fishing must receive social acceptance to avoid development of illegal fishing. In line with the 2030 Sustainable Development Agenda, governments had agreed a goal of prohibiting subsidies that contribute to overfishing, and illegal, unreported and unregulated (IUU) fishing by 2020. However, progress has been slow due to the stalling of the Doha round of trade negotiations related to reaching international agreement to reduce harmful fishery subsidies[5].

Figure 1: GLOBAL TRENDS IN THE STATE OF THE WORLD’S MARINE FISH STOCKS, 1974–2015

Source: FAO (2018)

Here, we consider national fishing areas within Exclusive Economic Zones (EEZ). Market-based (economic) fishery instruments are either price-based e.g. taxes and subsidies, or quantity-based e.g. individual transferable quotas[6]. Among economic instruments[7], we focus here on price policies: fishery taxes (fiscal policies) and subsidies. For each policy, we present the rationale for its use and some examples of application, and make some recommendations about policy design.

TAX POLICIES

Taxation which makes fishing activity more costly for the fishermen is used by governments to raise revenue and to make internalize to fishermen the environmental externalities they induce in terms of depletion of fish stocks. In theory, in an open access model, fishery taxation on catches works to increase the stock of fish at a given market price (Clark, 2006). Fishermen will always adjust their fishing effort to exhaust any possibility of additional profit. The stock of fish then depends positively on the marginal cost of effort, and negatively on the fish price net of taxes. Then, if the exogenous parameters were fixed and known it would be possible for a benevolent planner to achieve a sustainable fish stock by means of a catch tax.

However, if the price of fish rises or the cost of effort decreases due to technical progress the tax level would be inadequate (too low) which would cause the fish stock to decrease. For this reason, taxation alone is probably not the right instrument to regulate fish stocks. On the other hand, if the policy-maker sets a fishing quota such as a TAC program which guarantees conservation of the resource, a poorly defined tax would nevertheless reduce the fishermen’s profits. In this context, the tax would discourage the fishing effort and the increase in fishing capacity.

In practice, taxes are applied at different stages in the supply chain. They include fishing licenses, taxes on fish catch, harbor and landing fees, fish processing license fees, and fines for fishery infringements. Fishing licenses are common and are usually priced differently for national, foreign, small-scale, and industrial fleets (Porras, 2019). Foreign fleet licenses are used frequently by developing countries and island states with low harvesting capacity. Chesnokova and McWhinnie (2019) report that the average fee collected by source countries is quite small (6% of the value of the catch) although in the case of some developing countries, these fees represent a significant share of GDP.

Taxing fish catches or fishing efforts is rare or is at a level that avoids harming some fishermen. For instance, in Uganda, there is a daily landing charge of USD 0.25 per boat (FAO, 2004), and in Palau, long-liners pay USD 0.25/kg of fish landed (Porras, 2019). Up to 2012, France applied a consumption tax (Contribution pour une pêche durable) to retail of fish and fish products and food products containing more than 30% of seafood by weight (set at 2% of the amount excluding tax of product sales) but was removed to increase consumption.

In terms of the design of tax policies, it is preferable first to target large-scale industrial fleets because of their huge fishing capacity and also because it is more difficult to tax artisanal fisheries which tend to operate in informal markets. In the case of a fishing license, it would be possible to increase the fee for high-value species such as tuna, salmon, and cod (Porras, 2019). In line with the theory (Clark, 2006), taxes on fish catches should be combined with output controls such as TACs as currently applied by Iceland fisheries (Marchal et al., 2016), to ensure conservation of fish stocks and economic efficiency.

FISHERY SUBSIDIES

In theory, the effects of a subsidy are exactly opposite to the effects of taxation. Therefore, in the presence of over-exploited resources, when fishermen operate on the downward sloping part of their harvest supply curve, a subsidy decreases the fish stock and increases the price. This could explain the difficulty experienced in the Doha round of trade negotiations related to reaching international agreement to reduce the subsidies applied by fish-exporting countries: since subsidies increase the price of the resource, exporting countries will be reluctant to reduce them because of their favorable terms-of-trade (Bayramoglu et al., 2018).

In practice, worldwide fishery subsidies were estimated to be worth some USD 35.4 billion in 2018 (Sumaila et al., 2019a). The five major subsidizers, China, European Union, USA, Republic of Korea and Japan, contribute 58% (USD 20.5 billion) of total estimated subsidies. Following the classification in Sumaila et al. (2010), we can distinguish among “bad”, “good”, and “ambiguous” subsidies with regard to their impact on fish stocks. Good subsidies which contribute to the growth of fish stocks through conservation and the monitoring of fish catches, include grants for R&D and fishery management programs.

Bad subsidies which encourage more fishing and investment in capacity, include grants for the construction and modernization of boats and ports, tax exemptions, and fuel subsidies[8]. Around two-thirds of total subsidies (USD 22.2 billion) are considered capacity-enhancing. Sakai’s (2017) empirical evidence shows that in the absence of adoption of a quota policy, bad subsidies have negative effects on fish stocks five years later. The bad news is that the share of these subsidies in total subsidies increased between 2009 and 2018 (Sumaila et al., 2019a).

In terms of subsidy policy design, urgent action is needed to prohibit bad subsidies with adverse effects on fish stocks and to reallocate the available public funds to good subsidies. For instance, the removal of fuel subsidies which represents the greatest part of total subsidies (22%) would yield environmental benefits in terms of fish stock recovery and climate change mitigation. To avoid IUU fishing, the fines for non-compliance could be increased and subsidies that contribute to IUU fishing could be reduced (Hutniczak et al., 2019). An alternative would be to increase subsidies for IUU monitoring and evaluation aimed at fishery communities or cooperatives.

States keen to regulate their fishing must choose from a set of instruments whose effectiveness depends on the context and the objective, rather than a single measure. What is undeniable is the urgent need by 2020 to prohibit subsidies which increase overfishing and IUU fishing, in line with the 2030 Sustainable Development Agenda (Bayramoglu et al., 2019).

authored by Basak BAYRAMOGLU[1] and Jean-François JACQUES[2] [3]

References

Asche, F., Bellemare, M. F., Roheim, C., Smith, M. D., & Tveteras, S. (2015). Fair enough? Food security and the international trade of seafood. World Development, 67, 151-160.

Bayramoglu, B. Copeland, B. R. and Jacques, J-F., 2018. “Trade and fisheries subsidies.” Journal of International Economics, Elsevier, vol. 112(C), pages 13-32.

Bayramoglu, B. Copeland, B. R., Fugazza, M. and Jacques, J-F., 2019. “Trade and negotiations on fisheries subsidies”, VoxEU column, 21st October 2019.

Chesnokova, T., & McWhinnie, S. (2019). International Fisheries Access Agreements and Trade. Environmental and Resource Economics, 74(3), 1207-1238.

Clark, C. W. (2006). The worldwide crisis in fisheries: economic models and human behavior. Cambridge University Press.

Erhardt, T. (2018). Does International Trade Cause Overfishing?. Journal of the Association of Environmental and Resource Economists, 5(4), 695-711.

FAO (2004). Cunningham, S.; Bostock, T. (eds./comps.) Papers presented at the Workshop and Exchange of Views on Fiscal Reforms for Fisheries – to Promote Growth, Poverty Eradication and Sustainable Management. Rome, 13–15 October 2003. FAO Fisheries Report. No. 732, Suppl. Rome, FAO. 2004. 110p.

FAO, 2018. The State of World Fisheries and Aquaculture 2018. FAO, Rome.

Fugazza, M. and Ok, T., 2019. “Fish and Fisheries Products: from subsidies to non-tariff measures.” UNCTAD Research Paper Series. UNCTAD, Geneva.

Hutniczak, B., C. Delpeuch et A. Leroy (2019), « Closing Gaps in National Regulations Against IUU Fishing », OECD Food, Agriculture and Fisheries Papers, n° 120, Éditions OCDE, Paris, https://doi.org/10.1787/9b86ba08-en.

Marchal, P., Andersen, J. L., Aranda, M., Fitzpatrick, M., Goti, L., Guyader, O., … & Macher, C. (2016). A comparative review of fisheries management experiences in the E uropean U nion and in other countries worldwide: I celand, A ustralia, and N ew Z ealand. Fish and Fisheries, 17(3), 803-824.

Porras, I. (2019) Fair fishing. Supporting inclusive fiscal reform in fisheries. IIED, London. http://pubs.iied.org/16647IIED.

Sakai Y., 2017. “Subsidies, fisheries management, and stock depletion.” Land Economics, 93, 165-178.

Sumaila, U. R., Khan, A. S., Dyck, A. J., Watson, R., Munro, G., Tydemers, P., & Pauly, D. (2010). A bottom-up re-estimation of global fisheries subsidies. Journal of Bioeconomics, 12(3), 201-225.

Sumaila, U. R., Ebrahim, N., Schuhbauer, A., Skerritt, D., Li, Y., Kim, H. S., … & Pauly, D. (2019a). Updated estimates and analysis of global fisheries subsidies. Marine Policy, 109, 103695.

Sumaila, U. R., Villasante, S., & Le Manach, F. (2019b). Fisheries subsidies wreck ecosystems, don’t bring them back. Nature, 571, 36-36.

[1] Université Paris-Saclay, INRAE, AgroParisTech, Economie Publique, 78850 Thiverval-Grignon, France. E-mail: Basak.Bayramoglu@inrae.fr.

[2] Université Gustave Eiffel, ERUDITE (EA 437), UGE 77454 Marne la Vallée, France. E-mail: Jean-Francois.Jacques@u-pem.fr.

[3] The authors are grateful to Brian Copeland for constructive comments.

[4] Seafood is a highly traded good: in 2009, 39% of global seafood production was traded internationally (Asche et al., 2015).

[5] As a result, the 2019 WTO Ministerial Conference was postponed. The recent position adopted by the European Parliament and Council of the EU towards reintroducing some of the most harmful subsidies is less than encouraging (Sumaila et al., 2019b).

[6] Under an individual transferable quotas (ITQ) system, government first chooses an overall catch quota for a given species, and then allocates individual catch quotas to fishermen on an annual basis. Fishermen can exchange their fishing quotas in the market and a quota price then is established.

[7] Here, we do not discuss regulatory instruments such as fishing season closures, marine protected areas, input regulations, or TAC (total allowable catch). A TAC program would determine some “optimal” annual harvest level and control fishing activity accordingly (Clark, 2006). Policy instruments also include non-tariff measures (NTMs) and voluntary sustainability standards. See Fugazza and Ok (2019) for a discussion of current trends in the use of NTMs in the fishery sector.

[8] Ambiguous subsidies can lead to either resource enhancement or resource overexploitation. They include fisher assistance and vessel buyback programs.