COVID-19 has changed our lives. The pandemic has exposed the many fragilities of our economies, and deepened existing inequalities, while highlighting the need for resilience, innovation and cooperation in our societies.

As governments embark on resourcing and legislating COVID-19 relief and recovery measures, green fiscal policy approaches can play a key role in helping countries build back better. In the short-term, carbon taxation and/or fossil fuel subsidy reform can help generate and re-allocate significant resources for COVID-19 relief and recovery measures, while green budgeting can be a valuable instrument for medium-to long-term rationalisation and alignment of budgetary processes with government objectives for a sustainable and resilient post COVID-19 socio-economy.

Steven Stone is Chief of UN Environment’s Resources & Markets Branch (R&M). He holds a PhD in Resource Economics from Cornell University and has more than 20 years of professional experience in environmental and natural resource management.

Joy A. Kim has been working in the area of macro-economic and environmental policies for nearly 20 years. She is currently leading a ‘fiscal policy for green economy’ project and managing a ‘Green Economy in Africa’ project which supports more than 10 African countries’ transition to a green economy through Green Economy Assessments and Policy Analyses. She also serves as a co-chair of the Fiscal Instruments Research Committee of the Green Growth Knowledge Platform (GGKP).

Himanshu Sharma is the Manager of the Green Fiscal Policy Network. Before joining UNEP, he worked with CNRS France, the World Bank and the OECD on public policy issues across economic policy, financial regulation and the environment. He holds a dual degree MPA from LSE and SciencesPo Paris and a MBA in International Business from BIMTECH.

A PUBLIC HEALTH CRISIS AND A SOCIO-ECONOMIC CALAMITY

With hundreds of thousands of casualties worldwide, and climbing, and annual global costs of the pandemic in the range of $2.0 trillion to $4.1 trillion (2.3% to 4.8% of global GDP), COVID-19 has completely altered the landscape of our economies, and perhaps the underlying architecture, for the coming generation.

Labour market effects of necessary COVID-19 measures have been extremely damaging. Of particular concern is the plight of the almost 1.6 billion informal economy workers, accounting for 76 per cent of informal employment worldwide, who are significantly impacted by the lockdown measures and/or working in the hardest-hit sectors.

Source – ILO Monitor: COVID-19 and the world of work. Third edition, April 29, 2020

IT’S MOSTLY FISCAL

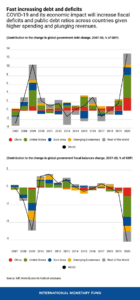

Due to a combination of high existing fiscal deficits and a risk of inflationary pressures, both the borrowing capacity, and monetary policy space, is constrained in most developing and low-incomes economies. Reallocating scarce public finance resources and reforming fiscal policy to find additional revenues will be priority actions required for most countries to respond to COVID-19.

Green fiscal policy can be important element in a government’s response toolkit for COVID-19 relief and recovery as it supports countries in rationalising inefficient expenditures such as environmentally harmful subsidies to create fiscal space and redirect the savings to the high priority sectors like health.

Green fiscal policy instruments like carbon taxation and fossil fuel subsidy reform can be especially effective in the current low oil price environment. For example, the IMF estimates that a carbon tax of $75 per ton would increase pump prices by less than the overall decline due to the oil price collapse. This should be combined with other measures like fee-bates to incentivise greener transport solutions and energy efficiency improvements and accompanied by smart communication and necessary assistance for low-income and vulnerable households and communities.

The collapse in oil demand and prices has also lowered the opportunity cost for fossil fuel subsidy reform. Removing fossil fuel subsidies and introducing taxes on fossil fuels that take externalities into account could provide average revenue streams to governments of about 2.6 per cent of global GDP. The scale of global fossil fuel subsidies means that reforming them could cover a large portion the “SDG financing gap”.

Green Budgeting can also be a valuable tool to increase the efficiency and effectiveness of budgetary processes and align them with climate and broader environmental objectives. It is efficient tool for decision-making on environmental and climate policy, which allows a precise management of green economy-compatible expenditures and taxes, and the identification of unfavourable expenditures (especially tax expenditures).

Not only would green budgeting allow governments to identify misalignments of spending and objectives and help identify possible resources which could be re-directed to COVID-19 relief measures, but also allow long-term integration of environmental and climate sustainability into budgetary processes.

WHY IS IT IMPORTANT TO INVEST IN SUSTAINABILITY TO BUILD BACK BETTER

The scale of current fiscal package is unprecedented in the recent history and will leave a long-lasting impact in terms of where global economies will head in the coming decade. Hence, a consideration of resilience and sustainability is necessary to ensure a recovery that lasts and does not to derail from the sustainability track that the world leaders have committed to under the SDGs.

In the short-term, focusing on environmental sustainability can actually deliver on some key criteria that most countries have for designing measures: job creation, multiplier effect on demand and economic activity, and the speed of these transmissions. For example, research estimates that “$1m invested in the oil and gas in the United States creates just five jobs, compared to 17 jobs per million dollars invested in energy-saving building retrofits, 22 jobs for mass transit, 13 for wind, and 14 for solar”.

In the medium to long term, the positive effects of a low-carbon and SDG aligned transition on the human, natural and physical capital of nations, and the increased resilience of the socio-economy to environmental and climate change risks also adds more weight to the necessity for an environmental sustainability framing stimulus measures for a post – COVID 19 future.

CONCLUSION

The health and economic crisis precipitated by the COVID-19 pandemic is unprecedented in modern times. This is a global calamity that requires urgent and substantive coordination and cooperation at a global scale to prevent a public health crisis from becoming a socio-economic catastrophe.

At the same time, the fiscal recovery packages put forward are also unprecedented in terms of its scale and how the funds will be deployed will determine which growth path global economy will take with long-lasting impacts. In the medium and long term, fiscal incentives in the clean energy or sustainable transport sector can stimulate the economy further by creating jobs and increase incomes while enhancing environmental sustainability of budgetary processes. Building back post COVID-19 global economy better, more resilient and sustainable through efficient and effective public finance should be the priority for leaders around the world.

WORKS CITED

- John Hopkins CSSE Map, https://coronavirus.jhu.edu/map.html, Accessed on April 3, 2020

- ADB, https://www.adb.org/news/developing-asia-growth-fall-2020-covid-19-impact, Accessed on April 3, 2020.

- ILO Monitor: COVID-19 and the world of work. Third edition, April 29, 2020 (https://www.ilo.org/wcmsp5/groups/public/@dgreports/@dcomm/documents/briefingnote/wcms_743146.pdf)

- “The Covid-19 Shock to Developing Countries: Towards a “whatever it takes” programme for the two-thirds of the world’s population being left behind”, UNCTAD, March 2020 (https://unctad.org/en/PublicationsLibrary/gds_tdr2019_covid2_en.pdf)

- Capital Flows Report: Sudden Stop in Emerging Markets, IIF, April 09, 2020. (https://www.iif.com/Publications/ID/3841/Capital-Flows-Report-Sudden-Stop-in-Emerging-Markets)

- April 2020 Global Debt Monitor: COVID-19 Lights a Fuse, IIF, April 07, 2020 (https://www.iif.com/Publications/ID/3839/April-2020-Global-Debt-Monitor-COVID-19-Lights-a-Fuse)

- IMF Special Series on COVID 19 – Greening the recovery, April 2020. (https://www.imf.org/~/media/Files/Publications/covid19-special-notes/en-special-series-on-covid-19-greening-the-recovery.ashx?la=en)

- Parry, I., Heine, D., Lis, E., & Li, S. (2014). Getting energy prices right: From principle to practice. (IMF, Ed.). Washington.

- Schmidt-Traub, G. (2015). Investment Needs to Achieve the Sustainable Development Goals Understanding the Billions and Trillions. SDSN Working Paper (Vol. Version 2). Retrieved from http://unsdsn.org/resources/publications/sdg-investment-needs/.

- The Guardian, https://www.theguardian.com/commentisfree/2020/apr/20/climate-crisis-will-deepen-the-pandemic-a-green-stimulus-plan-can-tackle-both.Accessed on April 21, 2020.