Dr. Dirk Schoenmaker and Dr. Dion Bongaerts propose green certificates as an alternative green investment structure that they show to be conceptually superior to green bonds. At the same time, this structure achieves the same type of environmental earmarking as green bonds do.

About the Authors

Dirk Schoenmaker

Dirk Schoenmaker is a Professor of Banking and Finance at the Rotterdam School of Management, Erasmus University and Director of the Erasmus Platform for Sustainable Value Creation. He is also a Fellow at the think tank Bruegel. His research covers the fields of sustainable finance, central banking, financial supervision and European banking. Before joining RSM, Dirk worked at the Dutch Ministry of Finance and the Bank of England. Dirk is (co-)author of Principles of Sustainable Finance (OUP), Financial Markets and Institutions: A European Perspective (CUP) and Governance of International Banking: The Financial Trilemma (OUP).

Dion Bongaerts

Dion Bongaerts is an Associate Professor of Finance at RSM Erasmus University and Academic Director Fintech at the Erasmus Center for Data Analytics. He specializes in the behavior of credit rating agencies, the pricing of credit risky instruments, the origins and effects of market illiquidity, and FinTech (with a focus on Blockchain). His work has been presented at major conferences around the world, including the AFA, WFA, EFA, and NBER meetings and published in top tier academic journals including the Journal of Finance, Review of Financial Studies, and the Journal of Financial Economics. He has received several grants, including a Veni and a Blockchain Research grant from the Dutch National Science Foundation (NWO) and a Lamfalussy Fellowship from the ECB. He has several years of professional experience as a risk management quant at ABN-AMRO bank.

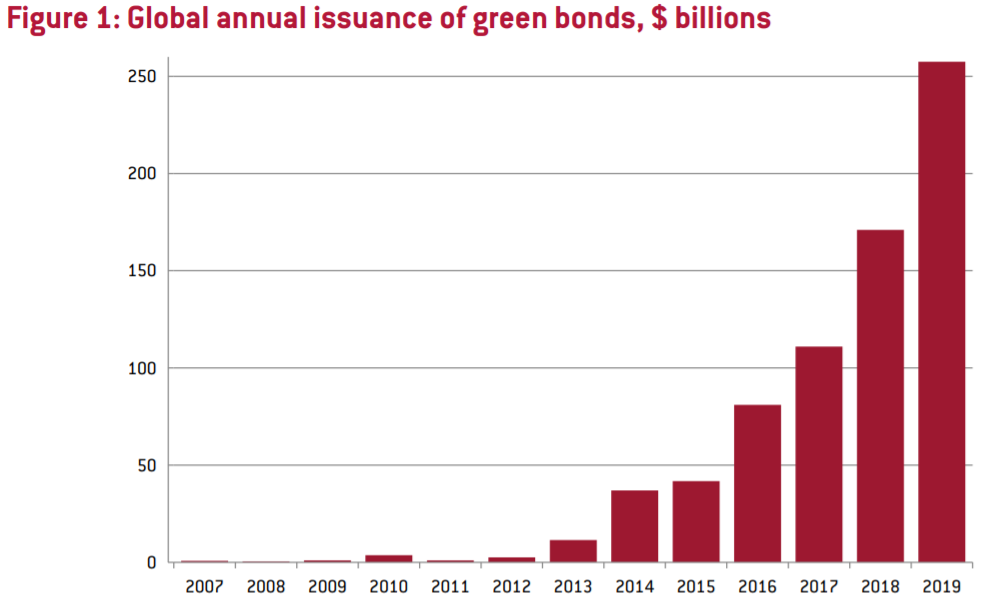

The market for green bonds is growing rapidly with public and private issuers (see Figure 1). The European Commission aims to finance €225 bln of the EU recovery package with the issuance of green bonds. Green bonds cater for a growing clientele consisting of green investors. However, green bonds fragment bond issues, which reduces liquidity and thereby increases financing costs. This undermines the economic rational for issuers for using green bonds. Moreover, green bond prices reflect liquidity, credit risk and environmental performance jointly. This makes it difficult to isolate the price (return) component related to environmental performance, which is a missed opportunity. Market prices that clearly reflect environmental performance foster transparency which encourages monitoring and facilitates incentive alignment by environmental performance-based compensation contracts of executives.

In our paper (Bongaerts and Schoenmaker, 2020a) and policy brief (Bongaerts and Schoenmaker, 2020b), we propose an alternative structure that we show to be conceptually superior to green bonds. At the same time, this structure achieves the same type of environmental earmarking as green bonds do. The sovereign debt office of the Danish central bank is currently considering such a scheme.

In particular, we propose to replace every green bond by a bundle consisting of a regular bond and a certificate that arranges the earmarking (we call this a green certificate). The regular bond and the green certificate are issued as a bundle in the primary market but can trade separately in the secondary market. Crucially, the holder of the certificate would be the only party with the right report the notional of the bond to be invested in an environmentally friendly way.

Our proposed structure is a type of financial engineering that yields several benefits. First, because no separate green bond issues are required, green projects can be financed along with other activities in regular bond issues. As a result, bond issues are larger, therefore more liquid, and because of that carry a lower liquidity premium in their bond spread. Operational costs are likely lower too, as for example no separate credit rating would be required for the green bond.

Second, this structure makes the cost and value of green earmarking simple and transparent. Investors can clearly see the returns they give up for green earmarking. With green bonds this is difficult. It requires talking the yield difference between the green bond and a perfectly matched reference bond (we call this the green spread). Yet, perfectly matched reference bonds are typically not available (except for German Bunds that are intentionally issued in pairs). One can try to match a green bond to a suitable yield curve, but yield curves are estimated with error. Such fitting errors are of similar magnitude as the yield differential between green and reference bonds.

Yield curve fitting errors also generate noise when using changes in green spreads as a measure of changes in environmental performance. We calibrate that this noise accounts for about 82% of the variance of changes in sovereign green spreads at an annual level and 95% at the quarterly level. By contrast, green certificates are perfectly transparent and do not require any matching exercise that introduces yield curve fitting noise. As a result, price changes of green certificates can be expected to be near perfect reflections of changes in environmental performance. Hence, observed price levels and changes of green certificates are much more informative about environmental performance and the returns investors sacrifice for green earmarking than levels and changes of green spreads. Using transaction costs rather than yield curve fitting errors as a source of noise gives similar results.

The prospect of informed trading creates scope for properly selected green certificates to appreciate in value following good environmental performance, thereby providing additional reasons to participate in this market and invest.

Finally, we assess the likelihood that informed investors trade on information they have about environmental performance of green earmarked debt issuers. This is important for several reasons. Profit opportunities of informed trading provide reasons for investors to monitor issuers and generate their own independent research. This complements environmental performance ratings, which empirically have been shown to have relatively low levels of agreement across raters. Moreover, the prospect of informed trading creates scope for properly selected green certificates to appreciate in value following good environmental performance, thereby providing additional reasons to participate in this market and invest. An investor with environmental performance information could easily exploit that information by trading in green certificates. The capital required to do so is low and so are transaction costs. By contrast, a similar strategy involving green and reference bonds would require a position in a green bond and an opposite position in a reference bond. While the net position is small, the required positions in the individual bonds are large relative to the value of the information. Hence, the cost base for such trades is large and even small proportional transaction costs could quickly become prohibitively expensive. As a result, an informed trader is much more likely to exploit his or her information in green certificate markets than in green bond markets and green certificate prices would therefore be more informative about environmental performance of the issuer. Naturally, when it is prohibitively expensive to exploit environmental performance information, there would be no incentive to produce it to begin with. Hence, green certificates would encourage much more independent research on environmental performance than green bonds do.

Making the market transition from green bonds to green certificates is not straightforward, despite the conceptual advantages outlined above. For a market to really take off, critical mass is required. This critical mass is most easily achieved by having some large parties on board. At the issuer side, these would be the high-quality sovereigns. They have the mass and importance (the special status of super-safe assets) to achieve critical mass. On the investor side, large sovereign wealth funds, pension funds, and life insurers would be the natural parties to ask for such securities. From a practical side, however, the transition to a market based on green certificates rather than green bonds is relatively straightforward because the bundle of a regular bond plus a green certificate is conceptually equal to a green bond. Therefore, any special treatment extended to a green bond (e.g., in terms of collateral treatment) could be applied to a bundle of a regular bond combined with a green certificate as well. As the market for green certificates matures, such treatments can be fine-tuned.

For more information on green certificates, you can read the research paper and policy brief that accompany this blog post.