Climate policy is reaching a fever pitch in the year of COVID-19. The European Union and Japan have each announced ‘climate neutrality’ targets to reach net zero greenhouse gas (GHG) emissions by 2050. South Korea and China have similarly announced ‘carbon neutrality’ targets to reach net zero carbon dioxide (CO2) emissions by 2050 and 2060, respectively. President Joe Biden’s climate plan will have the US join the international chorus and commit to net zero CO2emissions by mid-century.

Ryan Rafaty is a Postdoctoral Research Fellow at Nuffield College, University of Oxford, where he works with the Climate Econometrics research project, and Senior Research Officer at INET-Oxford. He received his PhD in the Department of Politics and International Studies at University of Cambridge, where he remains associated as a Fellow at the Centre for Environment, Energy and Natural Resource Governance. His research investigates the design, sequencing, and comparative performance of climate change mitigation policies under varied political and economic regimes.

Felix Pretis is an Assistant Professor in the Department of Economics at the University of Victoria, and co-director of the Climate Econometrics research project at Nuffield College at the University of Oxford. Prior to joining UVic, he was a British Academy Postdoctoral Research Fellow at the University of Oxford where he also completed his PhD in Economics, and a visiting researcher at UC Berkeley. His research concentrates on econometric methods applied to climate change and his work on the economic impacts of climate change featured in the IPCC special report on 1.5C.

Geoffroy Dolphin is a postdoctoral Research Fellow at Resources for the Future. Geoffroy was previously a research associate of the Energy Policy Research Group. He received his Ph.D. in business economics from the University of Cambridge. His current research focuses on the implementation and impacts of climate policies, part of which was recently published in Oxford Economic Papers.

As the world converges towards ‘Net Zero’, it will soon face pressing questions as to which policies can reduce emissions at the astounding scale and speed that this objective requires. Pricing CO2 emissions – whether via a carbon tax, emissions trading system, or some hybrid scheme – has long been recommended as integral to reaching the world’s climate targets. “Getting the prices right”, i.e. accounting for present and future damages of emissions, and pricing them across all sources in the economy does provide a (statically) efficient way of reducing them.

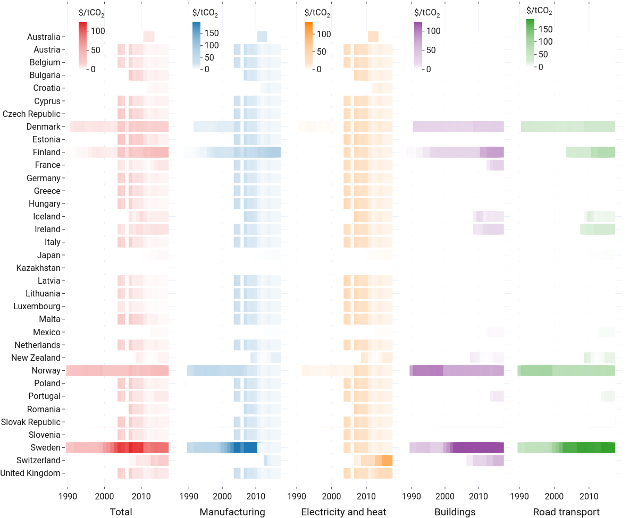

While not as widely adopted as other policies with GHG-reducing potential (such as feed-in-tariffs, renewable portfolio standards), carbon pricing mechanisms have long left the realm of theoretical abstractions. Since their first instance in Finland in 1990, several other jurisdictions have introduced mechanisms of their own, and have started pricing CO2emissions in various sectors of their respective economies (see Figure 1).

Colour-coded tiles indicate the presence of a carbon pricing initiative (tax and/or ETS) in a given year, with higher opacity (darker tiles) reflecting higher carbon price levels (2015 US$/tCO2). Based on emissions-weighted carbon price (ECP) data updated from Dolphin et al. (2020) for purposes of sector-level analysis. Sector- and economy-level prices are weighted averages of fuel-level prices.

Importantly, the jurisdictions committed to tackling climate change and which have carbon pricing mechanisms in place are now looking at ways to strengthen them so as to bring them in alignment with their respective emissions reduction objectives. Notable recent instances are Canada, the EU and Norway: Canada is set to gradually increase its federal carbon tax to USD135/tCO2 by 2030; the EU is currently drawing legislation that would align the emissions cap of its ETS with the emissions reduction objective endorsed in December 2020; and Norway’s latest climate policy announcement includes an increase of its carbon tax to USD240 by 2030.

Yet surprisingly little is known about the real-world performance of this core pillar of climate policy. Our original paper contributes to a fuller understanding of this question by empirically investigating the environmental efficacy of carbon pricing across five sectors for a panel of 39 countries from 1990 to 2016. We aim to answer three questions:

- What is the effect of the introduction of carbon pricing on CO2 emissions, irrespective of the level of the carbon price?

- Do higher carbon price levels lead to greater reductions in CO2 emissions?

- Once a carbon price is set, what is the effect of subsequent year-on-year changes in the price level?

We answer each of these questions in turn. We show that carbon pricing has reduced annual growth in emissions by roughly 1-2% relative to our estimated counterfactual, with an (imprecisely estimated) approximate 0.1% reduction in the growth rate of total emissions for each additional $1/tCO2. The response of emissions to a higher price level is imprecisely estimated in all sectors with the potential exception of manufacturing (with approximate 0.2% reductions per $1/tCO2). After the carbon price has been introduced, each marginal price increase of $1/tCO2 has altered the growth rate of CO2 emissions by -0.01% in the manufacturing sector, -0.2% for electricity and heat generation, -0.15% in buildings, -0.75% in road transport, and -0.15% for the economy as a whole.

Combining our empirical estimates of the effects of the introduction and subsequent increases of carbon pricing with scenarios of projected future emissions, we arrive at an important result: that carbon pricing at current observed levels even if implemented globally (or to a large share of world GHG emissions) is unlikely to achieve emission reductions at the scale and speed necessary to achieve the commitments of the Paris Agreement. Achieving the required emission reductions in line with the Paris Agreement requires global carbon pricing with near 100% emission coverage and in excess of $110/tCO2, which is roughly 50% higher than the highest existing average (emissions-weighted) carbon price, currently observed in Sweden.

As our simulations indicate, the (low) estimated elasticities imply that relying on carbon pricing alone would likely be insufficient to achieve emissions reduction compatible with the Paris Agreement. These results therefore suggest that carbon pricing mechanisms should be complemented with other “companion” policies that address other externalities (e.g. consumer myopia) impeding the development and deployment of GHG-free technologies and processes. If designed well, such mixes of overlapping but complementary policies could help overcome existing technological lock-in(s), which could raise the medium- to long-term price elasticity of CO2 emissions.

Moreover, while low (short-term) elasticities would preclude any quick response of emissions to the introduction of a price, they would imply a stable and sustained stream of revenues, unlike other climate policies. This revenue could in turn be used to alleviate the distributional impacts of the pricing mechanism (e.g. housing weatherization programs, direct financial compensation for the lowest income deciles, …) or invested in abatement technology development programmes.

Given the relatively low elasticities, revenues from carbon pricing mechanisms could be substantial (at least upon inception) and come to represent a significant share of governments’ revenue, especially in low and middle income countries. As an illustration, at USD25/tCO2, it would represent about 2% of total tax revenues in the US, 1.4% in Japan, 0.7% in the UK; it would represent about 11% in Egypt, 7% in South Africa, 10% in Malaysia, and 8% in Indonesia.[1]

Overall, our analysis corroborates the findings of Grubb (2014), Mercure et al. (2014), and others suggesting that climate change mitigation policies, when strategically combined, may be highly synergistic. In this context, carbon pricing has the potential to be a powerful tool contributing to economy-wide emission reductions while raising revenue that can be earmarked for specific use that further enhances the effectiveness of climate change mitigation policies or address some of their potential adverse impacts.

[1] These calculations assume that the carbon price applies to fuel combustion in power production (electricity and heat), road transport, manufacturing industries and construction, residential heating. The calculations assume 2018 emissions levels and hence are an approximation of actual revenue streams. CO2 emissions data is from International Energy Agency and government revenue data (“Total tax revenue in USD”) is from OECD.